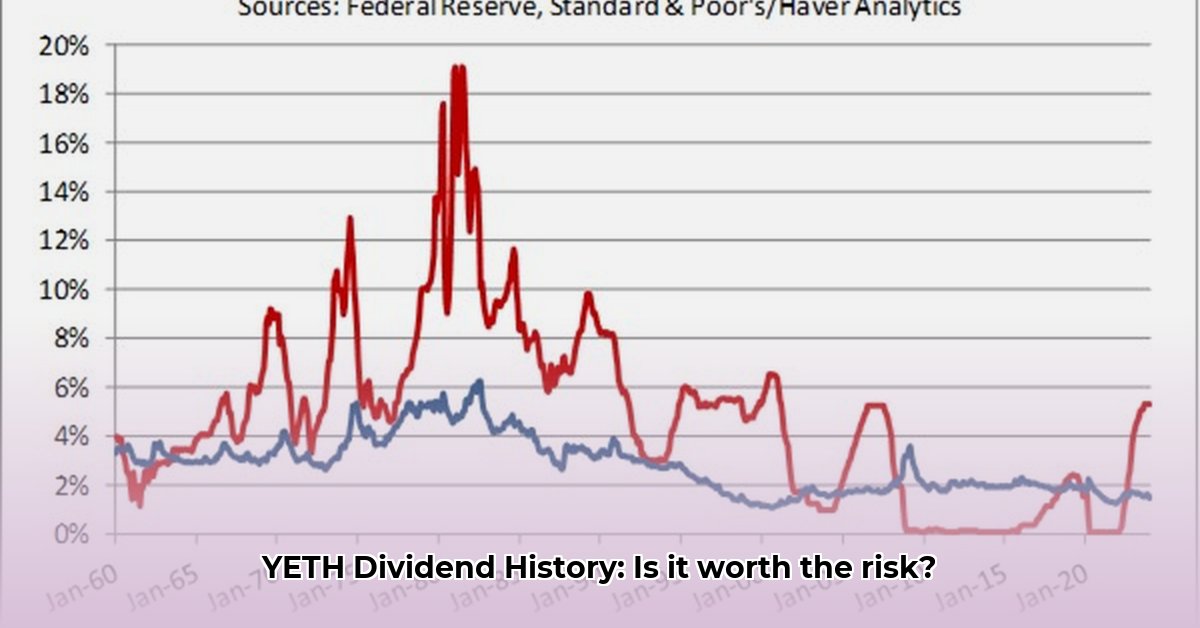

The YETH ETF has garnered attention for its purportedly high dividend payouts, but conflicting information surrounding its dividend history raises serious concerns for potential investors. Discrepancies in reported yields, ranging from approximately $14 to $43 per share annually, necessitate a thorough examination before committing capital. This informational article analyzes the available data, highlights inconsistencies, and provides a framework for independent verification.

Unraveling the Discrepancies in YETH Dividend Data

Multiple sources provide conflicting information regarding YETH's dividend payouts. One source claims an annual dividend of roughly $14 per share, while another indicates a significantly higher figure of approximately $43. This dramatic difference immediately flags a need for careful scrutiny. Both sources acknowledge monthly payments and a recent payment in January 2025, but beyond that, the data diverge substantially. One source offers detailed historical payment information but lacks key details on the payout ratio (the percentage of earnings distributed as dividends), a crucial element for evaluating sustainability. The other source, while showing a higher yield, presents extensive gaps in its data, marked as "N/A." These inconsistencies prevent a reliable assessment of the ETF's dividend performance.

Key Discrepancy: The most significant challenge lies in reconciling the vast difference between reported annual yields, ranging from approximately $14 to $43 per share. This highlights the critical need for independent verification from multiple sources.

Assessing the Risks Associated with YETH Investment

The lack of reliable data presents substantial risks for potential investors. Relying solely on the higher yield figure, without independent verification, equates to investing based on speculation rather than informed analysis. A seemingly high yield could reflect an unsustainable dividend policy, potentially indicating a higher risk profile. Further, the reported fluctuation in monthly payments suggests potential instability in the ETF's underlying assets or dividend strategy.

A Step-by-Step Guide to Verifying YETH Dividend Information

Before investing in YETH, potential investors should undertake the following steps:

Cross-Reference Data: Compare dividend information from multiple reputable financial websites, brokerage platforms, and the ETF issuer's official website. Discrepancies across sources require further investigation.

Analyze Financial Statements: Review YETH's financial statements, paying close attention to the payout ratio and historical dividend data. A sustainably high dividend yield requires a robust payout ratio reflecting consistent profitability.

Understand Underlying Assets: Examine the ETF's portfolio composition. The performance of the underlying assets directly influences the dividend payout. Assess the risk profile of these assets.

Consult Financial Professionals: Seek expert advice from a qualified financial advisor. This will allow for the creation of a diverse portfolio aligning with your specific risk tolerance and financial goals.

Actionable Steps for Key Stakeholders

The following recommendations outline the critical next steps for key stakeholder groups:

| Stakeholder | Immediate Action | Long-Term Strategy |

|---|---|---|

| Potential Investors | Verify YETH dividend information from multiple reliable sources; consult a financial advisor. | Continuously monitor YETH's performance and financial reports; diversify investments. |

| Financial Analysts | Conduct independent analysis; publish findings transparently. | Develop analytical models to forecast future dividend behavior. |

| ETF Provider (if known) | Address the discrepancies; ensure transparent and accurate reporting of data. | Strengthen data validation and reporting processes for future accuracy. |

Risk Assessment for YETH Investment

A comprehensive risk assessment is crucial before investing in YETH:

| Risk Factor | Likelihood | Severity | Mitigation Strategy |

|---|---|---|---|

| Inaccurate Dividend Data | Very High | Very High | Verify data from multiple reliable sources; seek expert advice. |

| Dividend Cuts | High | High | Diversify investments; create a robust financial plan. |

| Poor Underlying Asset Performance | Medium | High | Thoroughly research the ETF's underlying assets and their risk profiles. |

| High Yield Risks | High | Very High | Exercise extreme caution; understand the risks associated with high-yield investments. |

Conclusion: The Importance of Due Diligence

The inconsistencies surrounding YETH's dividend data underscore the paramount importance of conducting thorough due diligence before making any investment decision. Relying on a single source or accepting high yields without careful scrutiny can lead to significant financial losses. A multi-faceted approach, utilizing multiple data sources, expert advice, and a careful risk assessment, is crucial for making informed and responsible investment choices.